TOP 10 THINGS TO WATCH — THIS COMING WEEK

TOP 10 THINGS TO WATCH — THIS COMING WEEK

HEALTHCARE (1–3)

1. Healthcare Cybersecurity Incidents

- Expect: Continued ransomware or system outages affecting hospitals, insurers, or pharmacies.

- React: Avoid sharing medical data online this week; monitor EOBs and insurance portals for irregular activity.

2. Drug Pricing & Insurance Policy Noise

- Expect: Policy statements or litigation updates around drug pricing, coverage limits, or PBM practices.

- React: Refill critical prescriptions early; save documentation in case formularies change.

3. Public Health Alerts (Localized, Not Pandemic-Scale)

- Expect: Regional advisories (respiratory illness, water contamination, heat-related health alerts).

- React: Treat local advisories seriously; ignore national panic framing unless data supports it.

FINANCE (4–7)

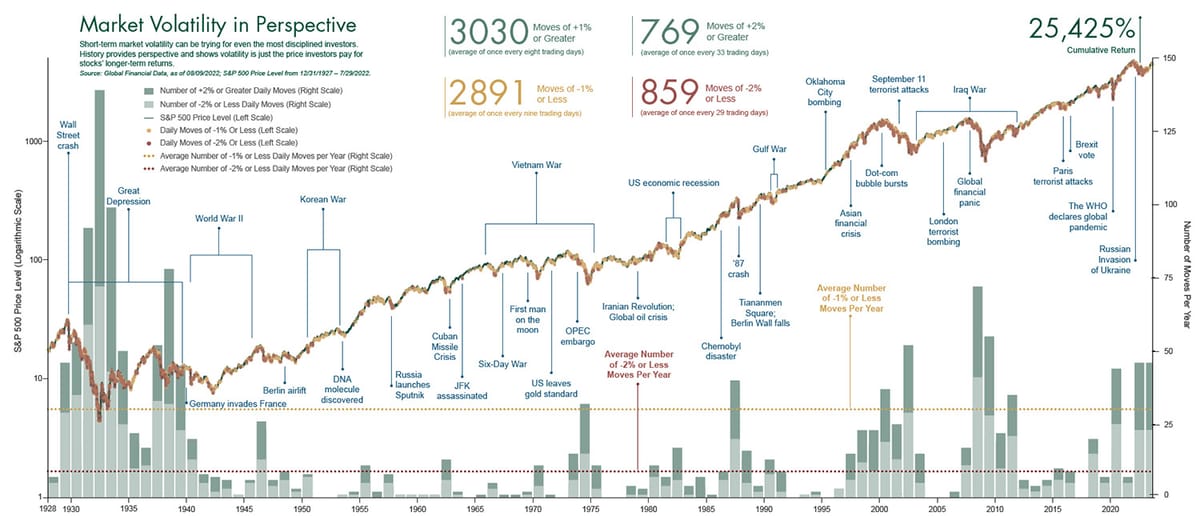

4. Market Volatility Around Rates & Inflation Signals

- Expect: Sharp short-term swings tied to inflation data, central bank commentary, or bond yields.

- React: Avoid emotional trades; if you’re not hedged, do nothing—cash is a position.

5. Bank & Fintech Stress Rumors

- Expect: Social-media-driven concern around specific banks, payment apps, or fintech platforms.

- React: Keep balances diversified; don’t move money based on rumors alone.

6. Consumer Credit Tightening

- Expect: Quiet reductions in credit limits, stricter approvals, or higher APR adjustments.

- React: Avoid maxing credit; document current limits and statements.

7. Energy & Commodity Price Spikes

- Expect: Oil, gas, or shipping-related price jumps tied to geopolitical news.

- React: Expect knock-on effects (fuel, food, transport); delay nonessential purchases if prices spike.

GEOPOLITICS (8–10)

8. Escalatory Rhetoric Without Immediate Action

- Expect: Strong statements from major powers without near-term military movement.

- React: Watch actions, not words. Markets overreact to rhetoric.

9. Supply Chain Pressure Points

- Expect: Renewed concerns around shipping lanes, rare earths, or food exports.

- React: Businesses should check inventory buffers; consumers should avoid panic buying.

10. Election & Political Shockwaves (Indirect Effects)

- Expect: Political developments influencing markets, sanctions, or trade posture.

- React: Focus on second-order effects (currency, tariffs, interest rates), not political theater.

BOTTOM LINE

- Volatility > catastrophe

- Noise > substance

- Preparation beats reaction

Stay calm, stay liquid, document everything, and don’t outsource judgment to headlines.

VISUAL SUMMARY — THIS WEEK’S RISK LANDSCAPE